Installment Loans That Fit every Lifestyle and Financial Needs

Wiki Article

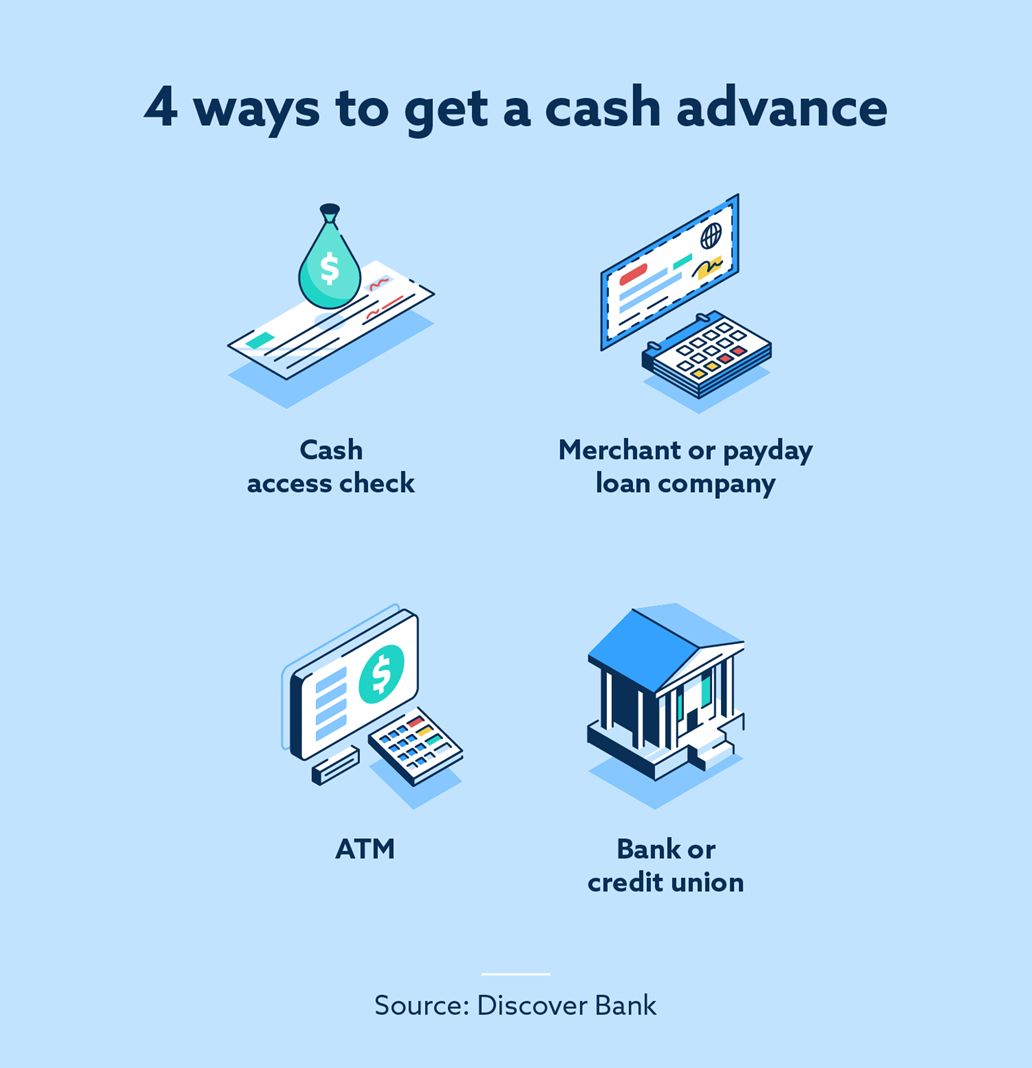

Qualification Needs for Cash Advance Finance: Discover the Advantages of Obtaining a Cash Money Advance

Eligibility needs for cash advance are simple yet vital for possible customers. Applicants should fulfill particular standards, consisting of earnings, residency, and age confirmation. These aspects not just promote a quick authorization process however also guarantee liable loaning methods. Recognizing these demands can brighten the benefits of obtaining a cash loan. What exactly do these advantages require, and just how can they impact one's financial circumstance?Comprehending Cash Advance Loans

Although payday advance can provide fast access to money, comprehending their framework and effects is important for possible borrowers. These temporary financings are usually created to connect the space between incomes, offering quantities that vary from a couple of hundred to a number of thousand dollars. Customers normally repay these loans on their following payday, which can bring about a cycle of financial obligation if not taken care of very carefully.Rates of interest on payday advance loan are frequently considerably greater than conventional fundings, which can result in considerable settlement amounts. The application procedure is normally uncomplicated, needing minimal paperwork, making them eye-catching for those in urgent requirement of funds. The ease comes with dangers, as failing to pay back on time can lead to additional costs and negative effects on credit score scores. Consequently, recognizing the terms and possible consequences before devoting to a payday advance loan is crucial for economic wellness.

Basic Qualification Requirements

Comprehending the basic qualification criteria for payday fundings is necessary for prospective customers. Typically, lenders require candidates to be employed, demonstrating a constant resource of income. This income can consist of wages from a work, government advantages, or various other trustworthy payments. In enhancement, debtors are usually expected to have an energetic monitoring account, which helps with the straight down payment of funds and automatic repayment.Lenders might likewise review applicants' financial history, including credit rating, although numerous payday loan providers do not depend greatly on credit history checks. This aspect makes payday advance loan interesting those with less-than-perfect debt. Moreover, candidates must be prepared to supply individual recognition, such as a motorist's license or social safety number, to verify their identity. Overall, satisfying these basic criteria is crucial for people looking for fast monetary aid through cash advance.

Age and Residency Needs

To get approved for a payday advance, candidates must meet certain age and residency needs established by lenders. Generally, people must be at the very least 18 years of ages, as this age is thought about the legal threshold for becoming part of agreements. Some states might impose a higher age restriction, so it is essential for applicants to confirm regional laws.Along with age, residency plays a considerable role in qualification. Lenders commonly need candidates to be residents of the state in which they are looking for the financing. This need guarantees that borrowers go through the certain laws regulating payday borrowing in their jurisdiction. Proof of residency, such as an utility costs or lease arrangement, might be asked for throughout the application procedure. Generally, fulfilling these age and residency requirements is important for people seeking to acquire a cash advance financing effectively and lawfully.

Employment and Revenue Verification

Lots of lending institutions require proof of stable work and a reliable earnings as part of the payday advance application procedure. This verification is important, as it shows the candidate's ability to settle the obtained quantity within the concurred timeframe. Generally, candidates might need to give current pay stubs, financial institution statements, or tax obligation returns to substantiate their income claims.Along with earnings documents, lenders commonly look for to confirm the candidate's employment status. A letter from a company or a direct call with the company may be needed to verify ongoing work.

These procedures aid lenders mitigate danger by guaranteeing that the debtor has the economic methods to accomplish their payment responsibilities. By establishing a clear understanding of the candidate's work circumstance, lending institutions can make enlightened choices relating to financing authorizations, inevitably helping with a smoother loaning process for those who qualify.

Examining Your Credit History

Checking one's credit rating is a vital action in the payday advance application process, as it can considerably influence loan authorization - Payday Loans. A higher credit scores rating typically brings about better finance terms, while a lower score may lead to greater rate of interest rates or being rejected. Comprehending approaches to boost a credit report can enhance an individual's possibilities of safeguarding a payday advance loan

Relevance of Debt Ratings

While prospective debtors often concentrate on immediate economic needs, recognizing the relevance of credit ratings is important when considering payday advance loan. Credit history ratings act as a monetary progress report, mirroring an individual's credit reliability based on previous loaning and repayment behaviors. A solid credit report score can enhance a consumer's confidence when looking for a cash advance, as it may indicate reliability to loan providers. On the other hand, a reduced credit rating can signify possible risk, influencing funding terms or eligibility. Additionally, borrowers knowledgeable about their credit history can make informed choices regarding payment techniques and lending quantities. Subsequently, examining and comprehending one's credit rating not only prepares individuals for the financing application procedure however likewise equips them to manage their monetary future efficiently.

Effect On Finance Authorization

Comprehending one's credit report can substantially influence the chance of finance authorization for payday fundings. Lenders typically assess credit ratings to assess an applicant's monetary responsibility and threat degree. A higher credit rating typically results in much better finance terms and a better chance Payday Loans of authorization, as it indicates a history of prompt payments. Conversely, a lower credit history may raise worries for lending institutions, potentially resulting in rejection or greater rate of interest. While payday advance are usually marketed as obtainable to those with inadequate credit, comprehending the subtleties of one's credit report can give beneficial insight into the authorization procedure. This recognition enables candidates to much better prepare and recognize the implications of their credit background on loan eligibility.

Strategies to Boost Rating

Examining one's credit rating score is an essential action in improving total credit wellness and improving eligibility for cash advance (Cash Advance). Individuals ought to frequently check their credit reports for errors, as errors can negatively influence ratings. Timely settlement of existing financial obligations is vital; regularly paying costs on schedule demonstrates integrity to lending institutions. Lowering credit score card equilibriums can likewise improve debt utilization prices, which influence scores significantly. Additionally, preventing new tough inquiries when seeking credit scores can prevent momentary dips in ratings. Developing a mix of credit report kinds, such as installment car loans and revolving debt, may even more enhance credit scores accounts. By implementing these techniques, people can function towards attaining a greater credit history rating, thus enhancing their opportunities of financing authorization and beneficial termsThe Significance of a Financial Institution Account

A savings account plays an essential duty in the cash advance application procedure. Lenders commonly need candidates to have an energetic bank account to assist in the car loan dispensation and settlement. This account works as a main technique for moving funds rapidly, ensuring that debtors receive their money advances without unnecessary delays. In addition, a financial institution account offers lenders with a method to validate the applicant's financial security and income via straight down payments.Having a savings account likewise aids develop a background of financial monitoring, which can be significant for lenders evaluating risk. Without a savings account, applicants might face challenges in securing authorization, as lenders typically watch it as an indication of monetary duty. On the whole, a checking account is not just a need; it is a vital component that simplifies the payday advance loan procedure and supports responsible borrowing methods.

Advantages of Safeguarding a Cash Breakthrough

While many financial alternatives exist, protecting a cash loan can supply immediate alleviation for people facing unanticipated expenditures. One significant benefit is the quick access to funds, usually available within hours, which is essential throughout emergency situations. This rate enables borrowers to attend to urgent expenses, medical expenditures, or repair services right away.In addition, cash loan commonly have fewer qualification needs compared to typical fundings, making them available to a more comprehensive range of people, consisting of those with less-than-perfect credit ratings. The straightforward application process commonly requires very little documentation, more streamlining access to funds.

Additionally, cash loan can aid construct monetary self-control. Customers can use this chance to manage their financial resources better, as timely payment can boost credit rating. Ultimately, the ease, access, and prospective financial advantages make securing a cash money advancement an appealing choice for lots of individuals seeking immediate monetary assistance.

Often Asked Questions

Can I Get a Cash Advance With Bad Debt?

Yes, individuals with negative credit rating can request a payday advance loan (Fast Cash). Many lending institutions concentrate a lot more on earnings and employment condition as opposed to credit report, making these financings available even for those with poor credit ratingJust How Swiftly Can I Receive Funds After Approval?

Typically, funds can be obtained within a few hours to the next business day after authorization. Processing times may differ based on the applicant and the loan provider's financial institution, impacting the general rate of disbursement. Impacting Exist Any Kind Of Fees Associated With Payday Loans? Yes, payday advance loans often feature different fees, including source fees and rate of interest fees. These charges can considerably increase the overall amount owed, making it necessary for debtors to comprehend the prices entailed prior to proceeding.Can I Settle a Payday Advance Loan Early Without Penalties?

Yes, most payday lending institutions allow early repayment scot-free. This choice makes it possible for debtors to reduce interest prices and settle their debts faster, advertising financial obligation and possibly boosting their debt standing in the future.What Happens if I Can't Repay My Payday Advance promptly?

If a person can not pay back a cash advance loan on schedule, they might incur extra fees, face raised rate of interest rates, or risk their account being sent to collections, possibly impacting their credit report adversely.Rate of interest rates on cash advance finances are usually significantly greater than standard financings, which can result in considerable repayment quantities. Examining one's credit history rating is a necessary step in the cash advance financing application procedure, as it can significantly affect loan approval. Recognizing one's credit rating rating can significantly affect the likelihood of loan authorization for cash advance lendings. While cash advance lendings are usually marketed as accessible to those with bad credit report, recognizing the subtleties of one's debt rating can give important understanding right into the authorization procedure. Developing a mix of debt types, such as installment lendings and rotating credit scores, might further boost credit history accounts.

Report this wiki page